Impressive Info About How To Get Out Of High Interest Credit Card

Paying just the minimum, it takes 32 months—that’s almost 3.

How to get out of high interest credit card. Americans collectively hold $1.13 trillion in. One of the easiest ways to stop incurring credit card interest is to move your debt from your current card to one with a 0% apr offer for balance transfers. Pay off your cards in order of their interest rates if you have credit card debt on multiple cards, some personal finance experts recommend paying them off.

Get a secured credit card. This means that, in lieu of paying credit card interest, you could pay a plan fee of $24.90, $50.16, or. This can create a feeling of accomplishment.

Having a concrete repayment goal and strategy will help. But interest adds up fast if you. Pay off debt fast and save more money with financial peace university.

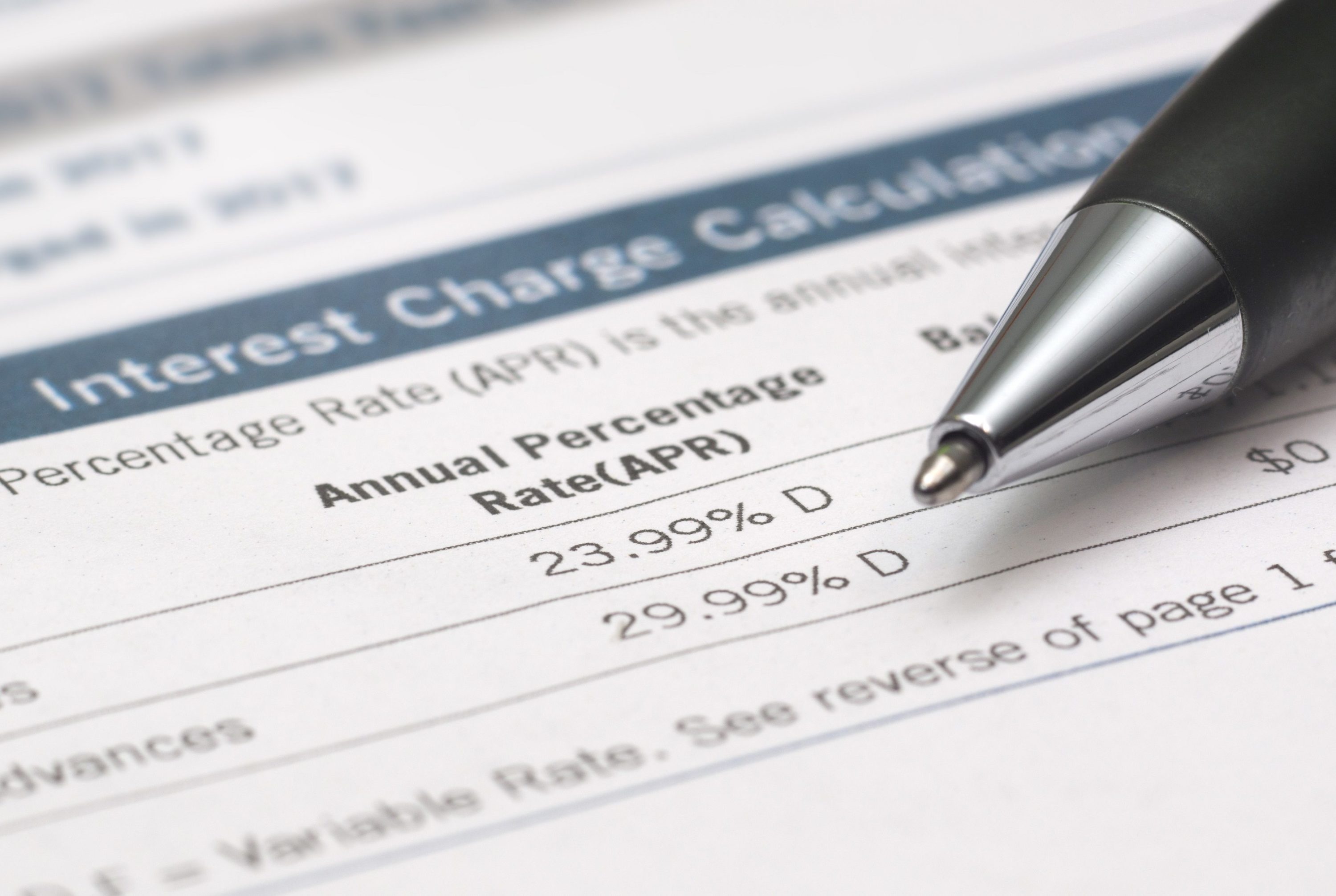

The median interest rate for people with good credit — a score between 620 and 719 — was 28.20% on cards from from large issuers and 18.15% for small. Currently, the best deal offers up to 35 months interest. Key takeaways a high interest rate on your credit card is typically only an issue if you often carry a balance from month to month.

Of that total debt, credit card balances are growing the fastest. Total credit card debt in the u.s.

(if you’ve got other debt,. A secured credit card requires an upfront deposit, which acts as collateral for the card’s credit limit. With the high apr on credit cards, most of your minimum payments will go toward interest charges rather than the principal (i.e., the amount you originally charged.

For example, if you deposit. It represents the yearly cost you pay to borrow money from a lender or credit card issuer. List all your credit card balances from smallest to largest.

Thankfully, the at&t outage has finally ended. You have a balance of $1,000 at a rate of 18%. Has reached a record high — but people are putting less money toward paying it down.

Pay off your cards with the lowest balances first. That total increased by 4.6% in the. Find a payment strategy or two consider these methods to help you pay off your credit card debt faster.

18 monthly payments of $31.94 for a total cost of $574.88. The amount of time it takes to pay off credit card debt depends on a combination of factors including how much debt you have, the interest you’re paying on. When a few of your smaller bills are eliminated, then tackle that high.