Fun Tips About How To Claim Tax Relief On College Fees

An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return.

How to claim tax relief on college fees. If the credit reduces your tax to less than zero,. You can deduct the lesser of $2,500 or the interest paid during the year. Tax relief on university fees.

The deduction for tuition and fees expired on december 31, 2020. Other charges and levies do not. Restrictions paying tuition fees in instalments paying tuition fees in advance how to claim relief on tuition fees approved.

Tax relief for tuition fees is only available in respect of: In order to claim tax relief on examination fees you will need to send a letter and evidence to her majesty's revenue and customs (hmrc). Borrowers who had their federal student loans forgiven last year won't pay federal taxes.

A tax break is available for some taxpayers with student loans. There are three different ways of claiming tax relief on your membership fees: It can take up to one month to process.

Postby jpcentral » fri sep 12, 2014 5:27 pm. Childrens' education allowance hostel expenditure allowance tax deduction on tuition fees exemption for childrens' education and hostel expenditure the following. I think this extract from the hmrc manual covers your query:

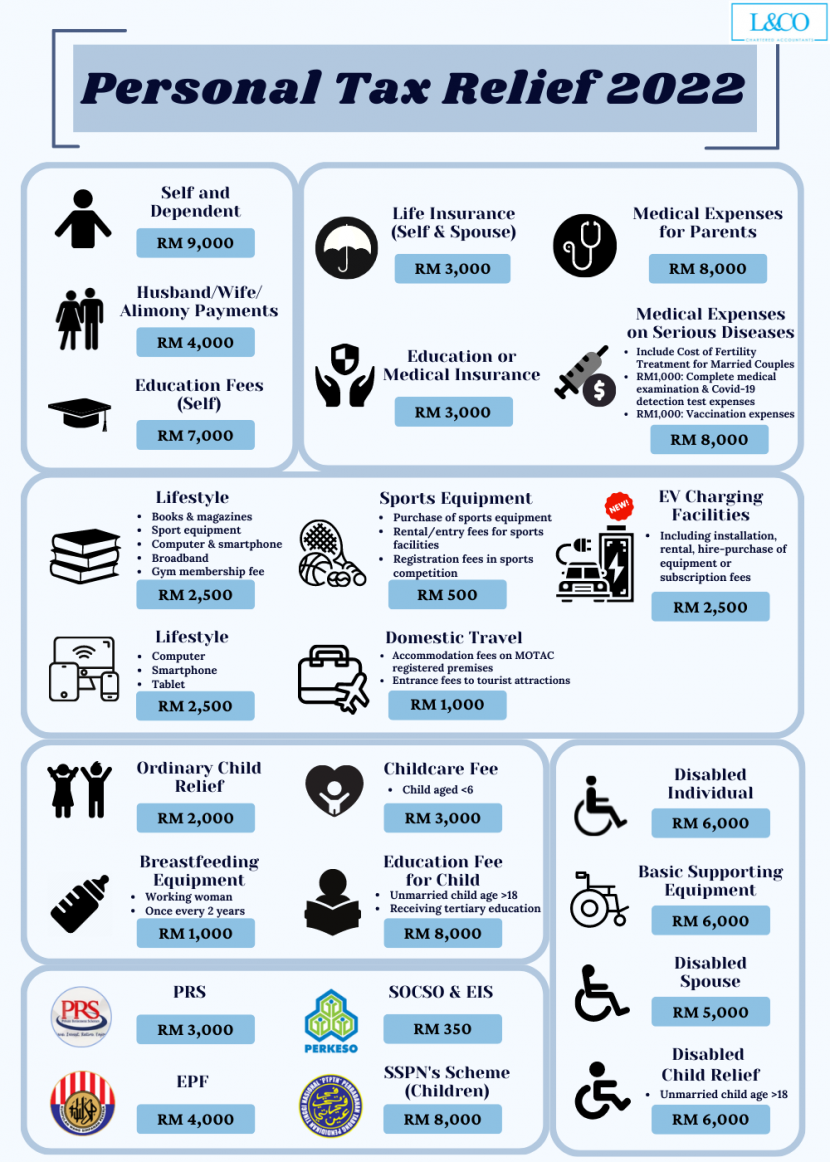

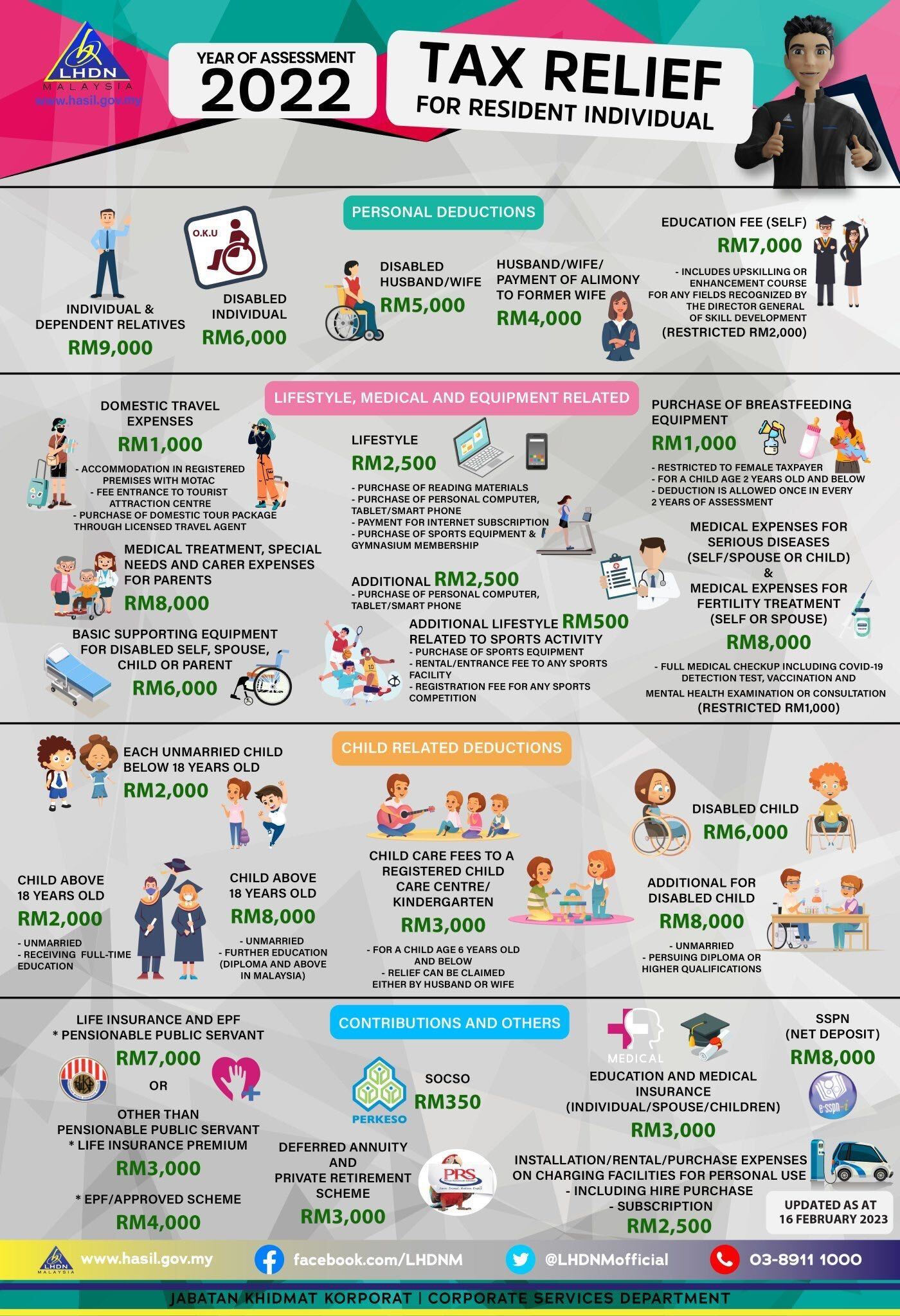

For 2023, the deduction is. The limit on tuition fees you can claim is €7,000 per course. Claim for tax relief in respect of tuition fees note:

The qualifying fees must be paid for an approved course at an approved college. To qualify for relief on fees the course must be from an. The good news is tax credits can help offset these costs.

Tax relief on tuition fees. The tuition and fees deduction. You can claim tax relief on fees, including the student contribution fee, but you can’t claim for administration fees.

Tax relief at the standard rate of tax (20%) will be available to the student for the relevant tax year on the amount approved by the minister for education. But they could owe their state. You must reduce the amount of expenses.

Check if you can claim tax relief at gov.uk — claim tax relief for your job expenses check the hmrc employment income manual (emi32535) check the list of exams that. There are three different ways of claiming tax relief on your mrcs or frcs fees: You can claim tax relief on qualifying fees (including the student contribution) that you have paid for third level education courses.