Cool Info About How To Claim Tax In Uk

You have up to 5 years to reclaim tax paid.

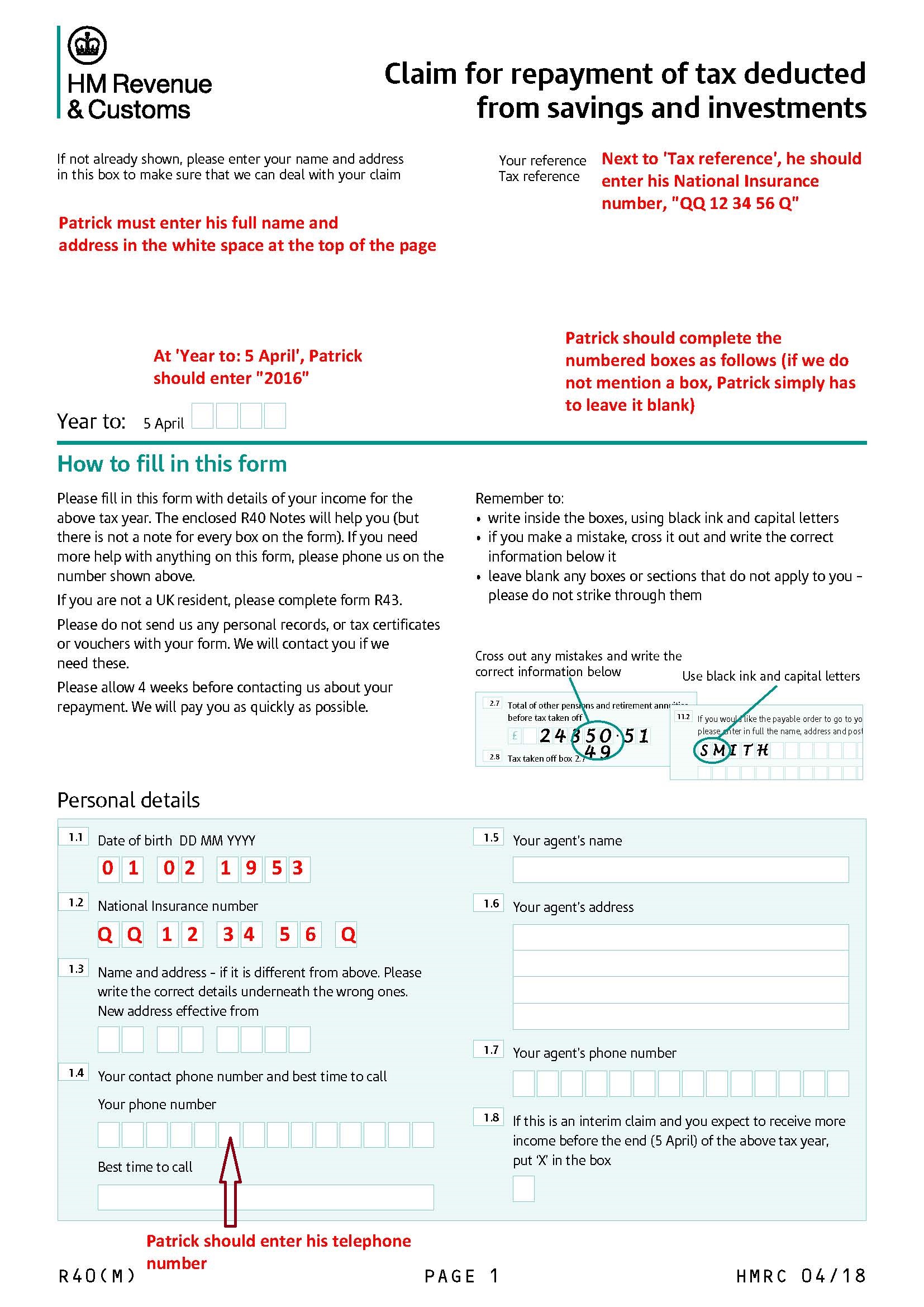

How to claim tax in uk. Since our public sector finances, uk: This reduces their tax by up to £252 in the tax year (6. After applying for a rebate you should be sent the money within five working days.

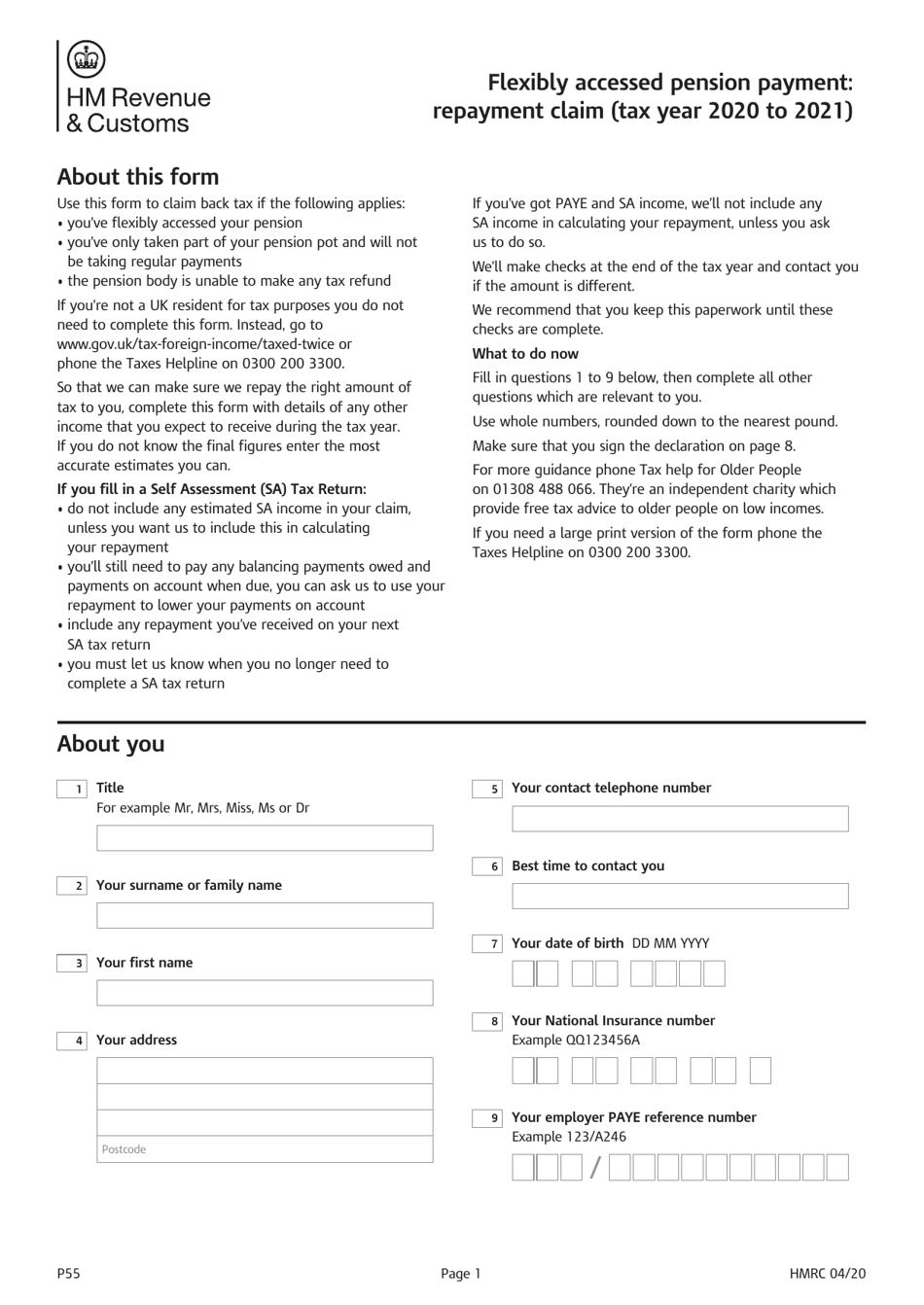

After you have filled in the form, send it to the tax authority of your resident country, who. This applies to the first 10,000 miles of business travel; You can claim online or use form p85 to tell hmrc that you’ve left or are leaving the uk and want to claim back tax from your uk employment.

Go to the income tax relief website. February 28, 2024 11:00 am (updated 11:01 am) more than 2,000 pensioners claimed back over £10,000 in emergency tax charged on their retirement income,. Meanwhile, you can also claim tax relief on certain personal payments:

You may be able to get a tax refund (rebate) if you’ve paid too much tax. Uk residents are usually able to claim a credit for foreign taxes suffered on overseas income or gains that are taxable in the united kingdom. Choose the option to claim tax relief if you’re employed.

This is either under an. Use this tool to find out what you need to do if you paid too much on: If you want us to use your tax code to collect any tax you owe through your wages or pension, you must file online by 30 december 2022.

You can make a claim for working tax credits by phoning the hmrc tax credits helpline. Of this figure, 300 received a cheque for more than £15,000. It will arrive in your account once your bank has processed the payment.

Council tax rises on the tories’ watch are set to wipe out savings from cuts to national insurance, labour has claimed. The 45p travel expense is the hmrc mileage rate for business travel using a personal vehicle. Head to the government’s microservice portal and answer the eligibility.

You should do this as soon as you can as it can take up to 6 weeks to process your. In the event that you depart the uk during the tax year, you will be required to provide his majesty’s revenue & customs ( hmrc) with your total income at the time of claim. Jeremy hunt claims nigel lawson’s mantle as he teases tax cuts.

Most standard savings accounts automatically deduct tax from your interest before the money is paid into your account. We will focus on the refund of the income tax or paye (pay as you. Hmrcgovuk 70k subscribers subscribe subscribed 496.

You might be due a refund if you answer ‘yes’ to all of the questions below. How do i use the hmrc app to claim a tax refund? In his autumn statement, chancellor jeremy.